tax ny gov enhanced star

Late Enhanced STAR applications due to good cause. Seniors who receive the STAR credit instead of the STAR exemption dont need to apply or take any other action.

74900 21123456 1000 158215.

. Here is the paperwork you need for the low-income senior and Enhanced STAR programs. This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not register for the Income Verification. By submitting this application you grant your permission.

Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. If you are interested in filing for the Basic and Enhanced STAR programs please contact the Nassau County Department of Assessment at 516 571-1500. For a list of who else should use this form see the instructions on page 2.

January 5 2021. STAR helps lower property taxes for eligible homeowners who live in New York State school districts. Homeowners who received a BASIC STAR Exemption on their 202122 tax bill who will be 65 or older as of December 31 2022 only one spouse or one sibling co-owner must be 65 by this date with a household income 92000 or less in 2020 may either.

WENY The New York State Department of Taxation and Finance is reminding property owners 65-years-old and older who are applying or reapplying to receive the Enhanced STAR exemption in 2019 that they now must enroll in the Income Verification Program IVP. Enrollment in automatic income verification is mandatory. You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible.

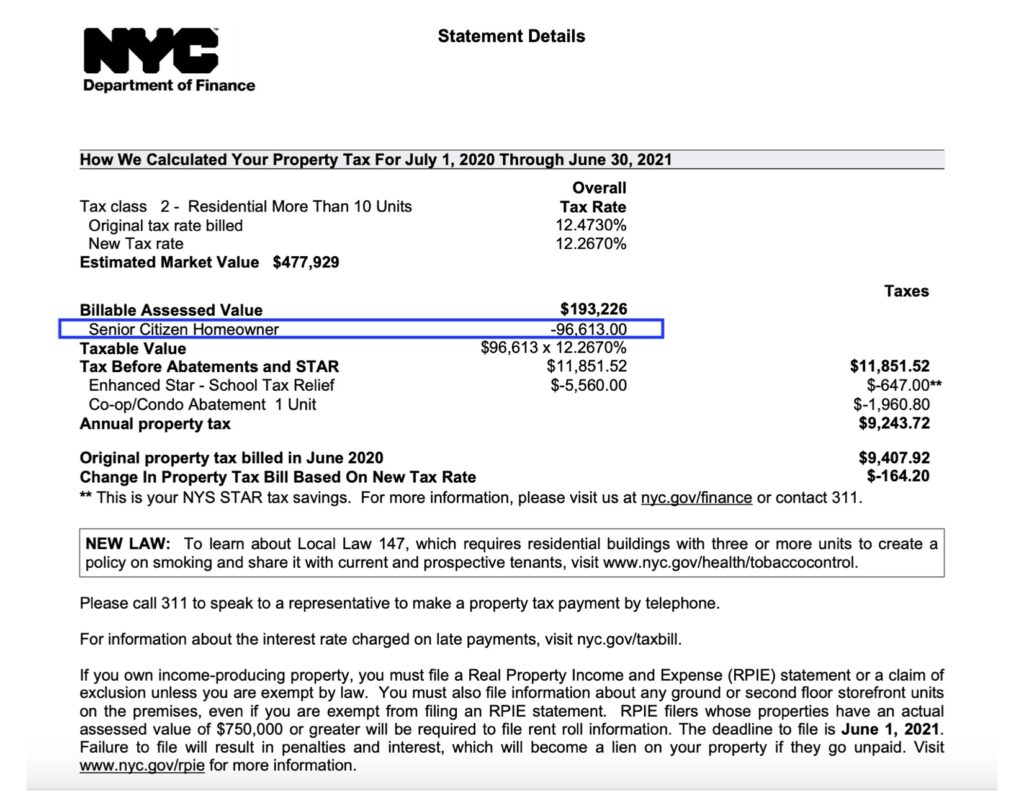

Enhanced STAR is one of several property tax exemption programs which are available to qualifying homeowners in NYC. Use Get Form or simply click on the template preview to open it in the editor. Qualified recipients of the Enhanced STAR exemption save approximately 650 in NYC property taxes each year.

See the STAR resource center to learn more. The New York State Department of Taxation and Finance will annually determine income eligibility for qualifying Enhanced STAR applicants. The Enhanced STAR exemption amount is 74900 and the school tax rate is 21123456 per thousand.

Enhanced STAR is available to owners of condos houses and co-ops who are 65 with. If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years. Qualifying property owners can reduce their property tax burden by taking full advantage of the many property tax exemptions that are offered by Nassau County.

A reduction on your school tax bill. The following security code is necessary to prevent unauthorized use of this web site. The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners.

With Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption. The Real Property Tax Law includes a provision to enable senior citizens to ask the Commissioner of Taxation and Finance for permission to file late Enhanced STAR exemption applications. The new limit for Enhanced STAR is 81900 it was 79050 for 201314.

Seniors with questions about the STAR exemption can contact the Tax Departments STAR Hotline from 830 am. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live. Register for the Basic and Enhanced STAR credits.

Quick steps to complete and e-sign Ny tax gov star online. Obtain the Enhanced STAR Exemption on their 202223 tax bill by filing the Enhanced STAR Exemption application and. The deadline to request the extension and apply for Enhanced STAR is the last day for paying school taxes without.

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less. Enter the security code displayed below and then select Continue. If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit.

The threshold to qualify has gone up. The State has changed the income threshold for Enhanced STAR for 201415. Enhanced STAR is a school property tax benefit that saves most senior homeowners in New York State hundreds of dollars each year.

The STAR program can save homeowners hundreds of dollars each year. Ad Download or Email More Fillable Forms Register and Subscribe Now. In this example 400 is the lowest of the three values from Steps 1 2 and 3.

If you are using a screen reading program select listen to have the number announced. If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence. Income for Enhanced STAR is the federal adjusted gross income minus the taxable amount of the total distribution from individual retirement accounts or annuities.

Who is eligible for Enhanced STAR. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. With the state tax department at wwwtaxnygov.

Enhanced STAR is available to senior citizens age 65 and older who own and live in their primary residence and who meet certain income requirements see below. Start completing the fillable fields and carefully type in required information. What is Enhanced STAR.

The benefit is estimated to be a 293 tax reduction. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. The Enhanced STAR savings amount for this property is 400.

The Tax Department will automatically upgrade them to Enhanced STAR if they qualify. As long as you. Basic STAR is for homeowners whose total household income is 500000 or less.

Use the Cross or Check marks in the top toolbar to select your answers in. Apply for property exemptions in New York state. Register with the NYS Tax Department at wwwtaxnygovstar.

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Property Tax Exemptions Available To Residents Syosset Advance

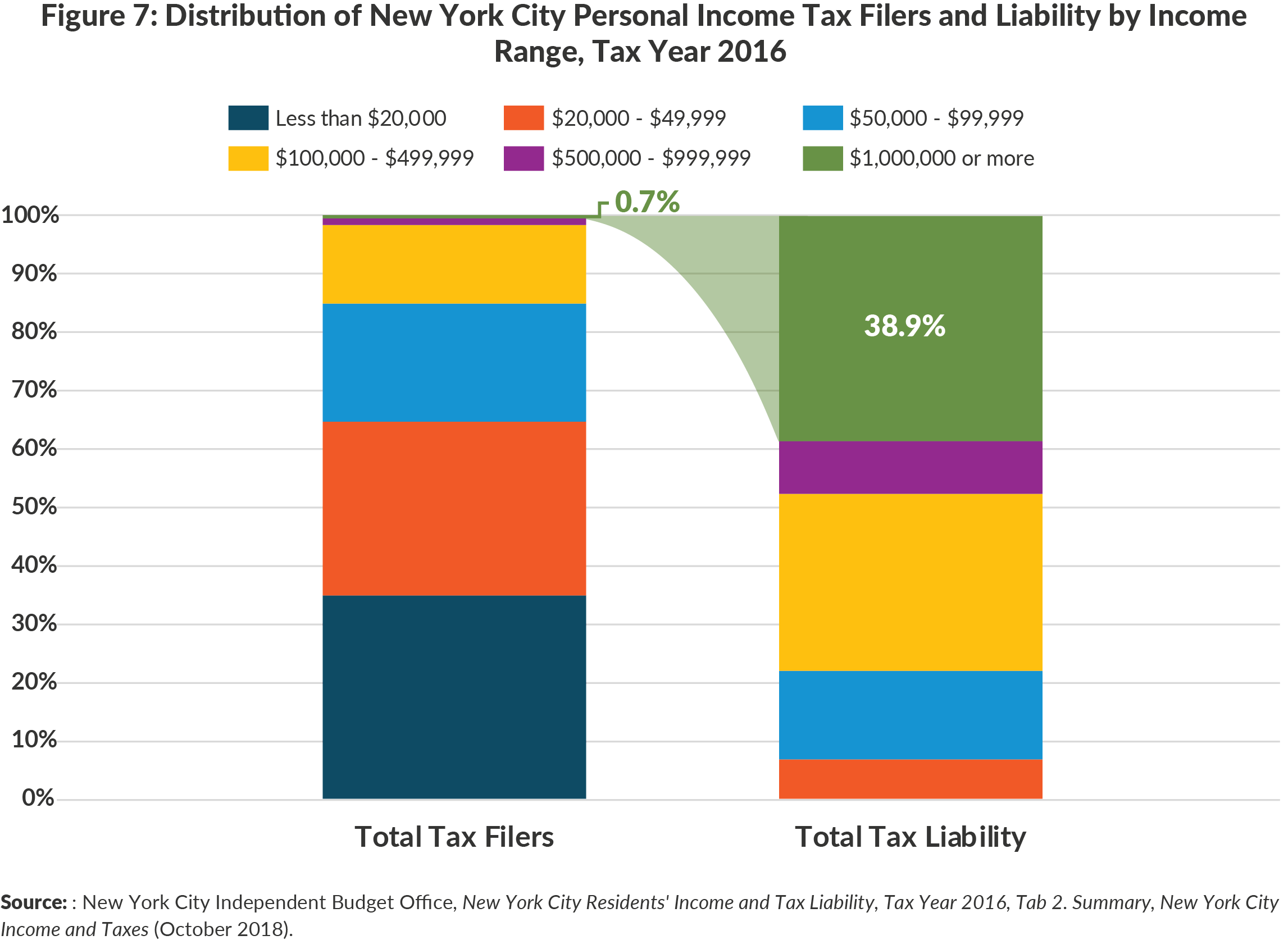

Personal Income Tax Revenues In New York State And City Cbcny

New Two Star Property Tax Relief Bill By Tedisco Lawler Seeks End To New York S Tax Eternity Ny State Senate

Village Tax Information Ossining Ny

Tax Exemptions Town Of Oyster Bay

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

The School Tax Relief Star Program Faq Ny State Senate

Department Resource Exemptions

Receiver Of Taxes Town Of Oyster Bay

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times